Today at CEF Investors, we are going to review the Gabelli Equity Trust, ticker symbol GAB. Is GAB right for you? We can answer that question in just a few minutes. We are going to look at the funds purpose, ratings, performance, dividends, holdings and NAV. At the end of this article we will sum up what we have learned and give GAB a grade in the top categories.

Disclaimer

But first the legal stuff. Make sure you read our disclaimer by clicking here before you make any financial decisions. Now, let’s get started.

YouTube Version Available

If you would like to view this article on our YouTube channel click here:

Overview

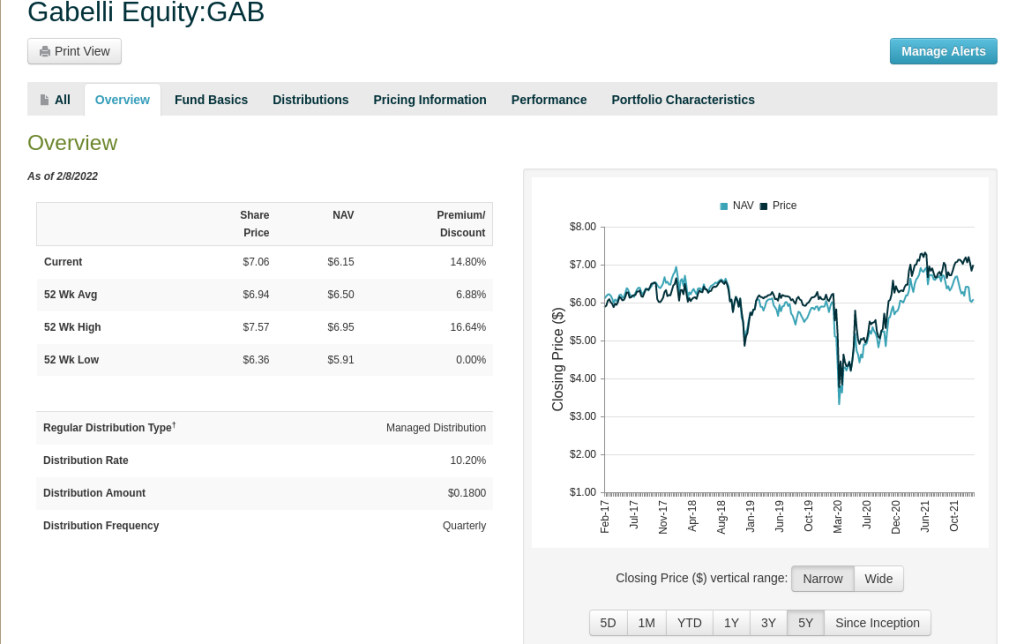

The Gabelli Equity Trust is a closed-end, non-diversified management investment company, whose investment objective, is long term growth of capital, with income as a secondary objective. Investments will be made, based on management’s perception, of their potential for capital appreciation. The Fund seeks out undervalued companies, with greater than average potential for growth. The Equity Trust, maintains a 10% Distribution Policy, whereby the Trust pays out to common shareholders 10%, of its average net assets each year. This distribution is paid quarterly. The distribution rate, is not representative of dividend yield, or the total return of the Fund, and may include a return of capital.

https://www.gabelli.com/funds/closed_ends/-111

Ratings

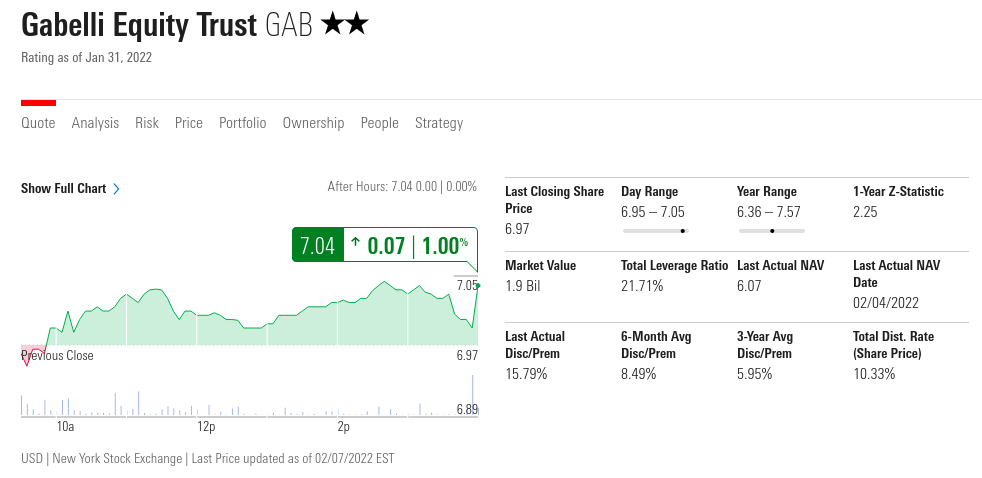

The first thing I like to check when researching a fund, is what do the experts say. Let’s hop over to Morningstar and get their rating.

Morningstar

Morningstar assigns star ratings based on their analysts’ estimates of a stock’s fair value. A 5-star stock is a good value at its current price; a 1-star stock isn’t. Star ratings, which are updated daily, can change for three reasons: because analysts alter their estimate of a stock’s fair value, because a stock’s price changes, or both. Ratings that change because analysts alter their estimate of a stock’s fair value, are marked with the asterisk symbol.

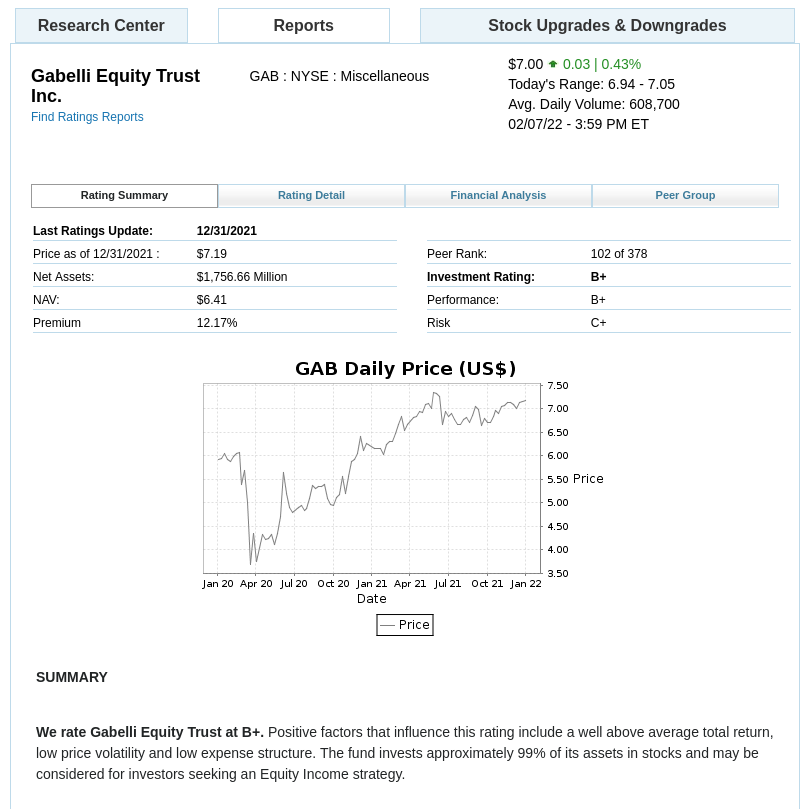

The Street

The next place I like to check out is The Street. On The Street’s website they say that, unlike many other rating agencies, they analyze both fundamental and technical risk factors. They use more rigorous standards for accuracy, to support their foundational belief, that a good investment should be able to perform well, regardless of the direction of the overall stock market.

The Street gives GAB an investment rating of B+, a performance rating of B+, and a risk rating of C+. Positive factors that influence this rating include, a well above average total return, low price volatility, and low expense structure. The fund invests approximately 99% of its assets in stocks, and may be considered for investors seeking an Equity Income strategy.

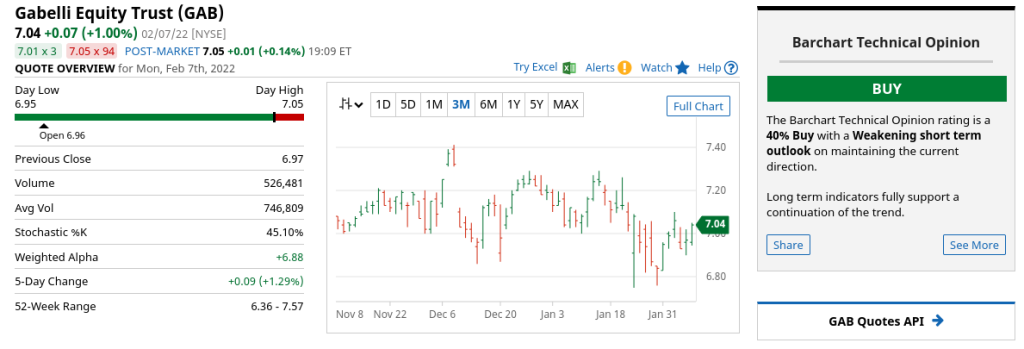

Barchart

And last, let’s look at Bar Chart. Bar chart Opinions, show traders what a variety of popular trading systems are suggesting, in terms of going long or short the market. The Opinions takes up to 5 years’ worth of historical data, and runs these prices through thirteen different technical indicators. After each calculation, the program assigns a buy, sell, or hold value for each study, depending on where the price lies, in reference to the common interpretation of the study.

Bar chart says that GAB, is a Buy. The bar chart Technical Opinion rating is a 40% Buy with a Weakening short term outlook on maintaining the current direction.

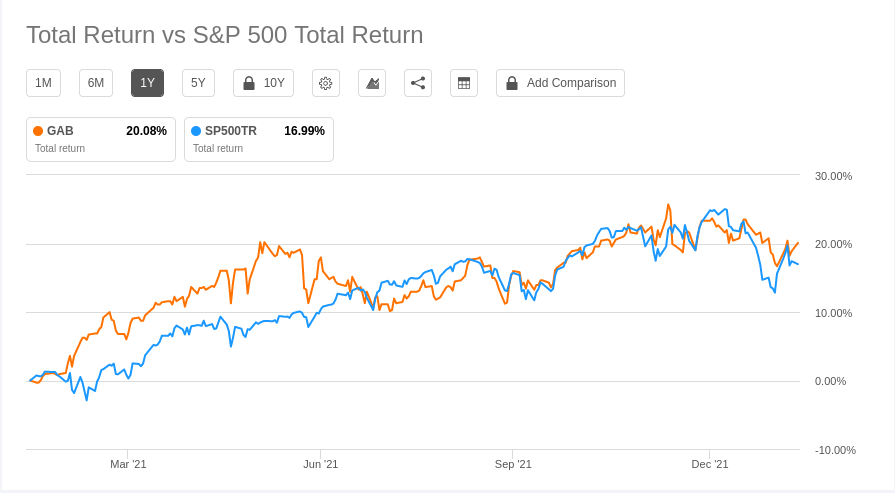

Total Return Performance

According to Seeking Alpha’s website, for the past year, the total return for GAB, has kept pace with the total return of the S&P 500, which is good performance! Due to the current volatility of the markets, the total return is currently even with the S&P 500.

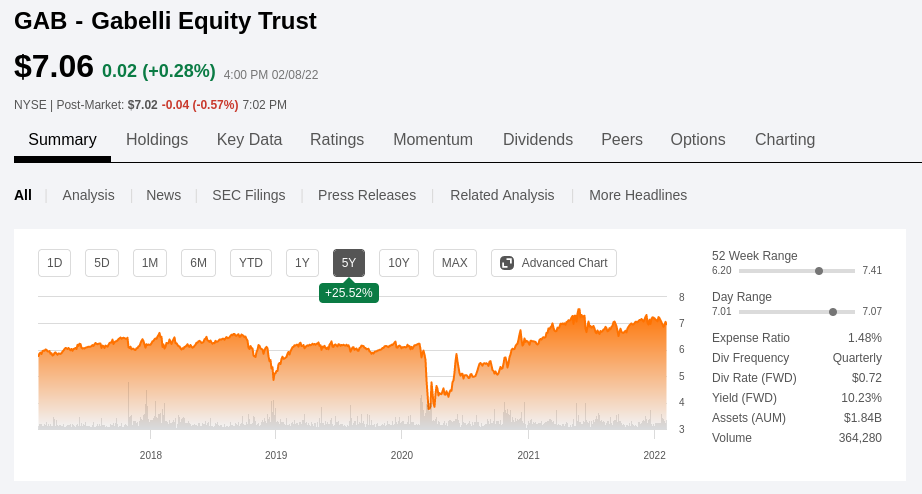

Price Performance

Seeking Alpha also shows, that the price of GAB for the last five years, has had steady growth, starting around five dollars, and steadily increasing to the seven dollar range.

Dividends

Continuing on, lets check out the dividends. Dividends are payments a company makes, to share profits with its stockholders. They are generally paid on a regular basis, usually monthly or quarterly, and they are one of the ways investors earn a return, from investing in stock.

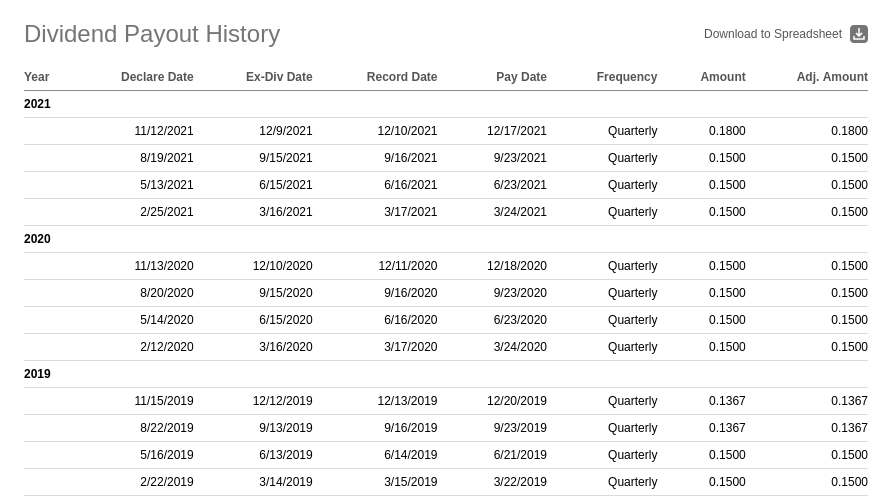

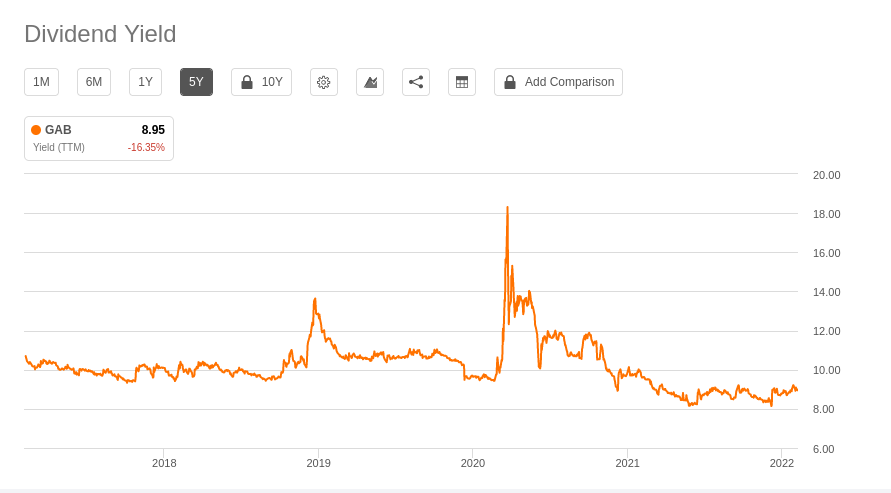

Again, according to Seeking Alpha, the dividend yield currently is around 10%, which is excellent. Also, this fund has raised it’s dividend for the last two years, which is also an excellent sign. If we look at the historical yields, we can see that for the last five years, the yield has generally been between 8 and 11 percent.

All in all, for the last 5 years, this fund has had very stable price and yield.

Sectors

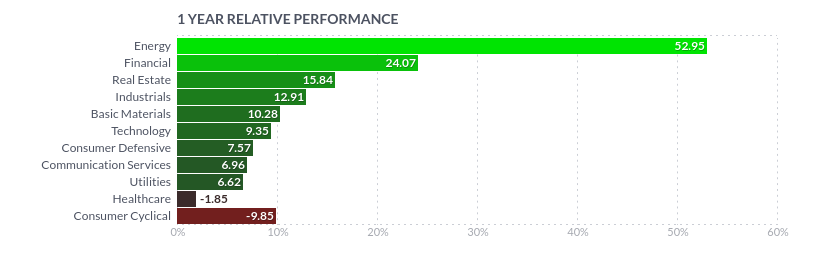

Before we look at the holdings of this fund, let’s find out what sectors are performing well. Comparing the sectors of our fund, to the sectors that are doing well, can give us valuable insight. Over at FinViz we can see, for the last year, that the top five sectors are Energy, Financial, Real Estate, Industrial and Basic Materials.

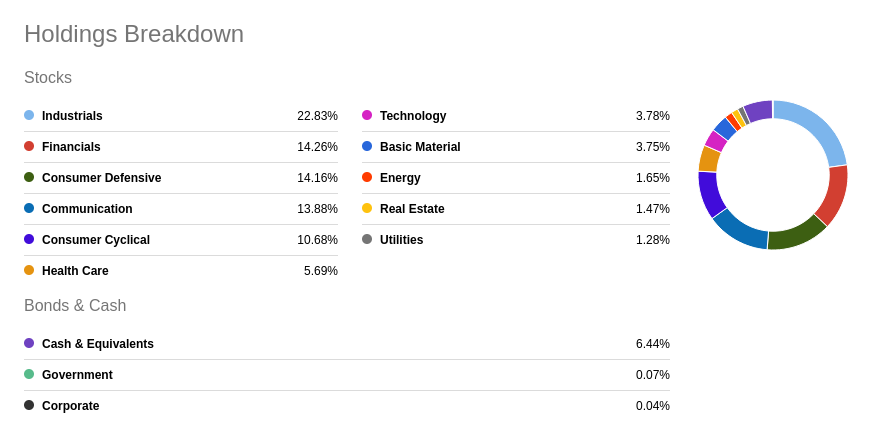

Holdings

Now let’s see what holdings are in our fund. At Seeking Alpha, we can see that the top five sectors are Industrials, Financials, Consumer Defensive, Communication and Consumer Cyclical. You can see that this fund is focused on two, of the top five performing sectors right now. The top 10 holdings, are some well know companies such as, US Treasury Bills, Swedish Match, Mastercard, American Express, Rollins, Deere, Berkshire Hathaway, AMATEK, Texas Instruments, and Honeywell International.

Net Asset Value (NAV)

What review of a closed-end fund would be complete, without a look at the <say-as interpret-as=’characters’>NAV</say-as>? Over at <say-as interpret-as=’characters’>CEF</say-as> Connect, we can see that for the last five years, this fund has traded at a premium. So if you are the type of investor, that always wants to buy at discount, then this fund is not going to be for you.

Disclosure

And as full disclosure, I currently own 100 shares of GAB, and will be looking to add more to my portfolio. This fund fits into my investment goals and strategy, as a solid performing, good paying dividend fund.

Conclusion

So is GAB a buy for you? Let’s review what we have covered. We have two different sources giving GAB a buy recommendation, and one giving a below average rating, so let’s give this fund a B for Ratings. Since GAB is keeping pace with the S and P 500, we need to rate this fund as an B for performance. Any time a fund can pay steady dividends between 8 and 10 percent, you would need to give it an B for dividends. After reviewing the holdings, and the main investment sectors, GAB should get a C for Holdings. You can see that GAB definitely has some things going for it, but may have some drawbacks for some investors. Maybe GAB can meet some of your investment goals and strategy.

Closing

Well, that raps up this article, thanks for reading. If you found this article helpful, please consider going to our YouTuble channel and liking, subscribing, and clicking the notification bell. Thanks, and we will see you next time.