Today at CEF Investors, we are going to review the Cornerstone Strategic Value Fund, ticker symbol CLM. Is CLM right for you? We can answer that question in just a few minutes. We are going to look at the funds purpose, ratings, performance, dividends, holdings and NAV. At the end of this article we will sum up what we have learned and give CLM a grade in the top categories.

Disclaimer

But first the legal stuff. Make sure you read our disclaimer by clicking here before you make any financial decisions. Now, let’s get started.

YouTube Version Available

If you would like to view this article on our YouTube channel click here:

Overview

The Cornerstone Strategic Value Fund was incorporated in Maryland, on May 1, 1987, and commenced investment operations, on June 30, 1987. The Fund’s investment objective, is to seek long-term capital appreciation, through investment in equity securities, of U.S. and non-U.S. companies. In determining which securities to buy for the Fund’s portfolio, the Fund’s investment adviser uses a balanced approach, including “value”, and “growth”, investing, by seeking out companies at reasonable prices, without regard to sector or industry, which demonstrate favorable long-term growth characteristics.

http://www.cornerstonestrategicvaluefund.com/

Ratings

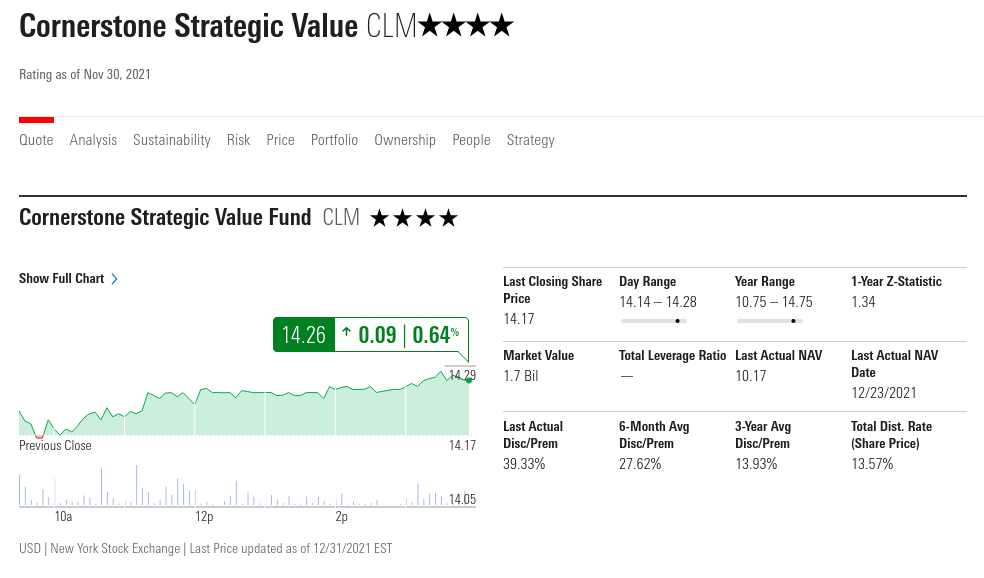

The first thing we like to check when researching a fund, is what do the experts say. Let’s hop over to Morningstar and get their rating.

Morningstar

Morningstar assigns star ratings based on their analysts’ estimates of a stock’s fair value. A 5-star stock is a good value at its current price; a 1-star stock isn’t. Star ratings, which are updated daily, can change for three reasons: because analysts alter their estimate of a stock’s fair value, because a stock’s price changes, or both. Ratings that change because analysts alter their estimate of a stock’s fair value, are marked with the asterisk symbol. Morningstar has rated Cornerstone Stategic Value Fund as four stars, so that’s good.

The Street

The next place we like to check out is The Street. On The Street’s website they say that, unlike many other rating agencies, they analyze both fundamental and technical risk factors. They use more rigorous standards for accuracy, to support their foundational belief, that a good investment should be able to perform well, regardless of the direction of the overall stock market.

The Street gives the Cornerstone Strategic Value Fund an investment rating of B, a performance rating of A+, and a risk rating of C. Positive factors that influence this rating include, a well above average total return, low price volatility and low expense structure. The fund invests approximately 99% of its assets in stocks, and may be considered for investors, seeking an Equity Income strategy. We are two for two so far.

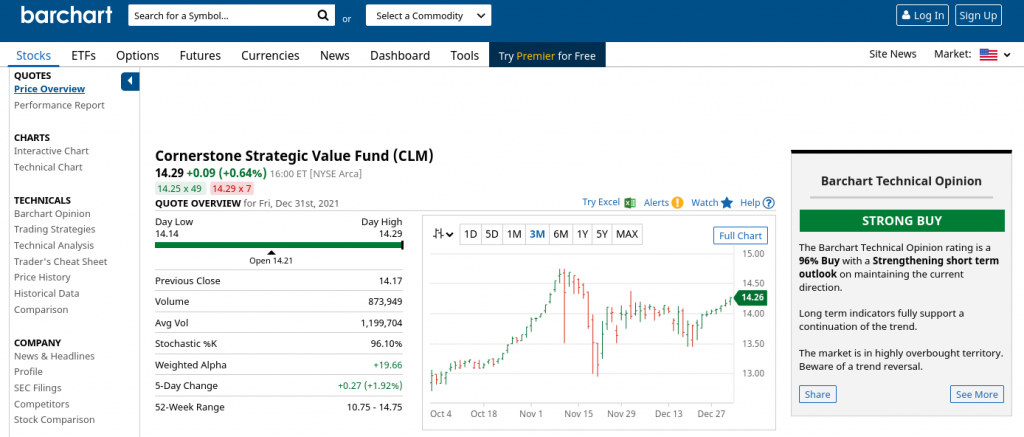

Barchart

And last, let’s look at Bar Chart. Bar chart Opinions, show traders what a variety of popular trading systems are suggesting, in terms of going long or short the market. The Opinions takes up to 5 years’ worth of historical data, and runs these prices through thirteen different technical indicators. After each calculation, the program assigns a buy, sell, or hold value for each study, depending on where the price lies, in reference to the common interpretation of the study. Bar Chart says that CLM, is a Strong Buy.

Performance

Now lets check out Cornerstone Strategic Value Fund’s performance. Total return, takes both capital gains and dividends into account, in order to provide a complete picture, of how a stock performed over a specified time period. This can be extremely useful, for evaluating investment returns among dividend-paying stocks, and for comparing the performance, of dividend-paying stocks to those without any dividends, or other distributions.

According to Seeking Alpha’s website, for the past year, the total return for CLM, has out performed the total return of the S&P 500, by about 10%, which is excellent performance! Seeking Alpha also shows, that the price of CLM for the last five years, has remained in the ten to twenty dollar range.

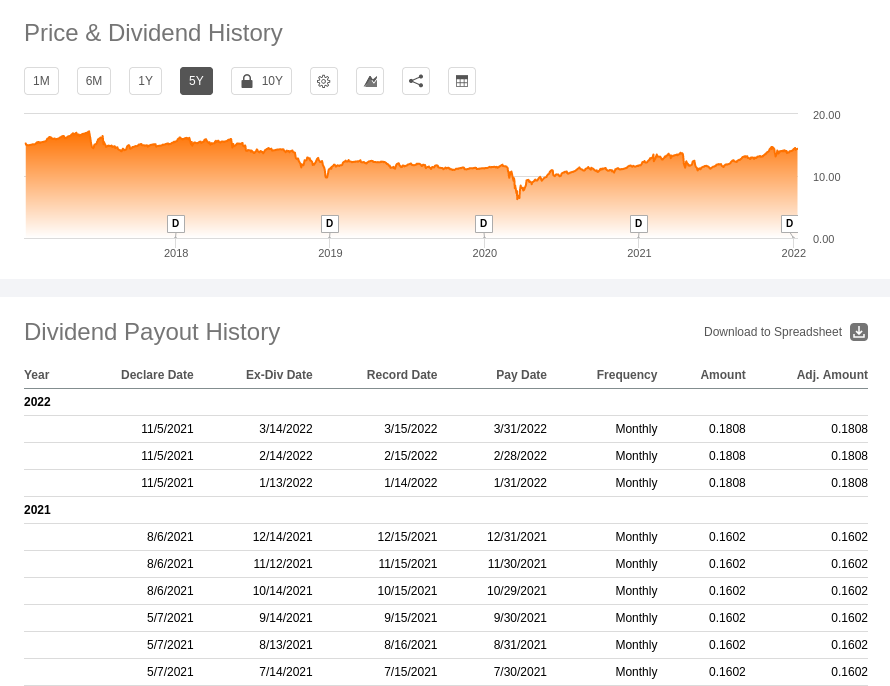

Dividends

Continuing on, lets check out the dividends. Dividends are payments a company makes, to share profits with its stockholders. They are generally paid on a regular basis, usually monthly or quarterly, and they are one of the ways investors earn a return, from investing in stock.

Again, according to Seeking Alpha, the dividend yield currently is around 15%, which is excellent. Also, this fund just raised it’s dividend for the first quarter of 2022, also an excellent sign. If we look at the historical Yield on Cost, we can see that for the last five years, the yield has generally been between 10 and 20 percent.

All in all, for the last 5 years, this fund has had very stable price and yield.

Sectors

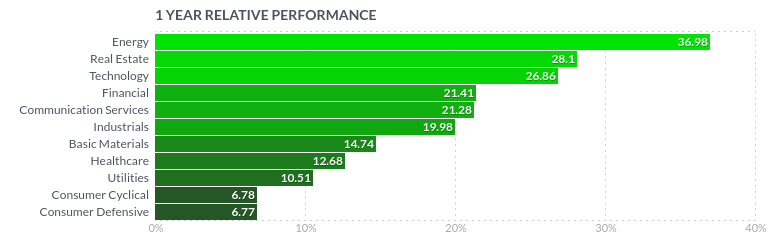

Before we look at the holdings of this fund, let’s find out what sectors are performing well. Comparing the sectors of our fund to the sectors that are doing well can give us valuable insight. Over at FinViz we can see, for the last year that the top five sectors are Energy, Real Estate, Technology, Financial and Communication.

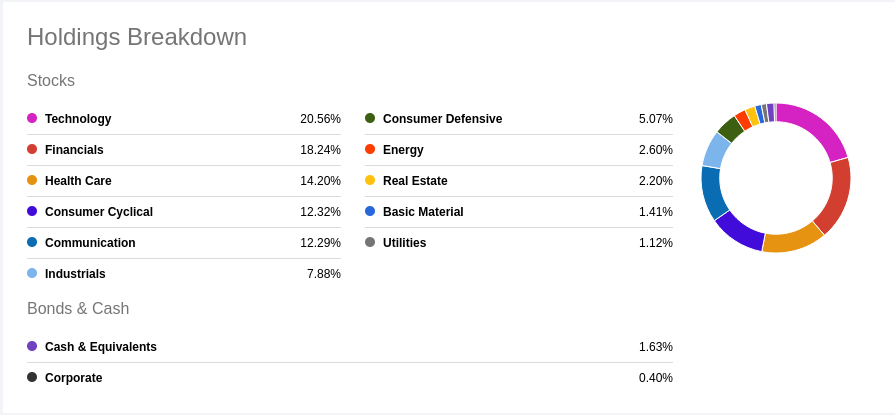

Fund Holdings

After that review, now let’s see what holdings are in our fund. At Seeking Alpha we can see that the top five sectors are Technology, Financial, Health Care, Consumer and Communication. You can see that this fund is focused on three of the top five performing sectors right now. The top 10 holdings are all well know companies such as, Amazon, Apple, Microsoft, Alphabet, Berkshire Hathaway, JP Morgan, Meta, United Health, Visa and Tesla.

Net Asset Value

And before we finish, what review of a closed-end fund would be complete, without a look at the NAV? Over at CEF Connect, we can see that for the last five years, this fund has traded at a premium. So if you are the type of investor, that always wants to buy at discount, then this fund is not going to be for you.

Disclosure

And as full disclosure, we currently own 100 shares of CLM and will be looking to add more to my portfolio. This fund fits into my investment goals and strategy as a solid performing, good paying dividend fund.

Conclusion

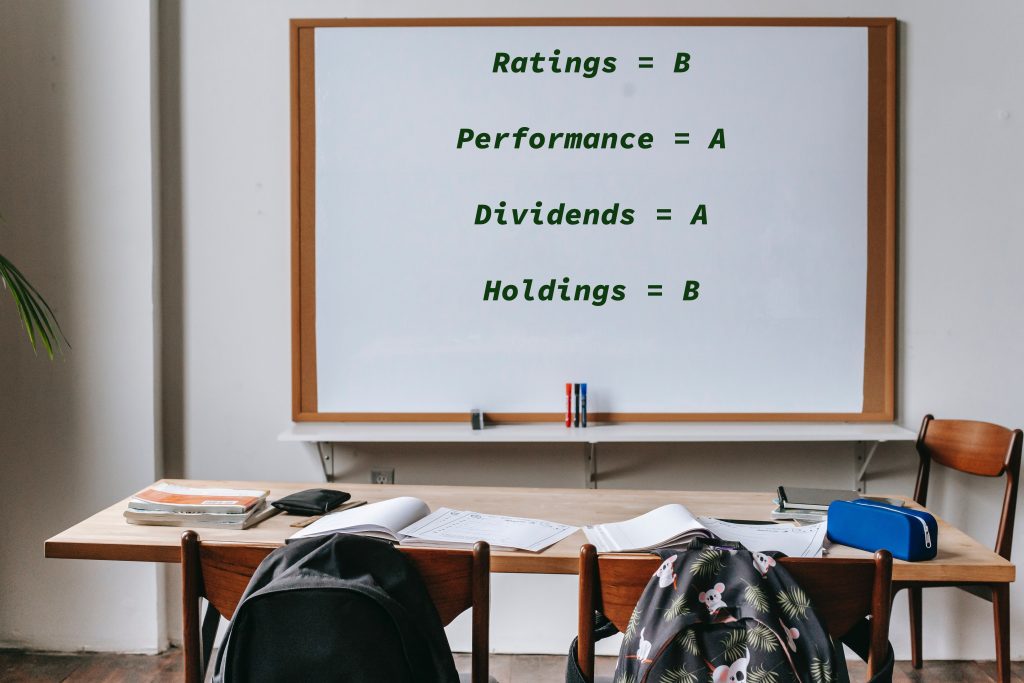

So is Cornerstone Strategic Value Fund (CLM) a buy for you? Let’s review what we have covered. We have three different sources all giving CLM a buy recommendation, so let’s give this fund a B for Ratings. Since CLM is out performing the S&P 500 we need to rate this fund as an A for performance. Any time a fund can pay steady dividends over 10 percent, you would need to give it an A also for dividends. After reviewing the holdings and the main investment sectors, CLM should get a solid B for Holdings. You can see that CLM definitely has some things going for it. Maybe CLM can meet some of your investment goals and strategy also. So if you are looking for a solid performing CEF, then Cornerstone Strategic Value Fund might just be for you.

Closing

Well, that raps up this article, thanks for reading. If you found this article helpful, please consider going to our YouTuble channel and liking, subscribing, and clicking the notification bell. Thanks, and we will see you next time.